…aaaaaand CUT!

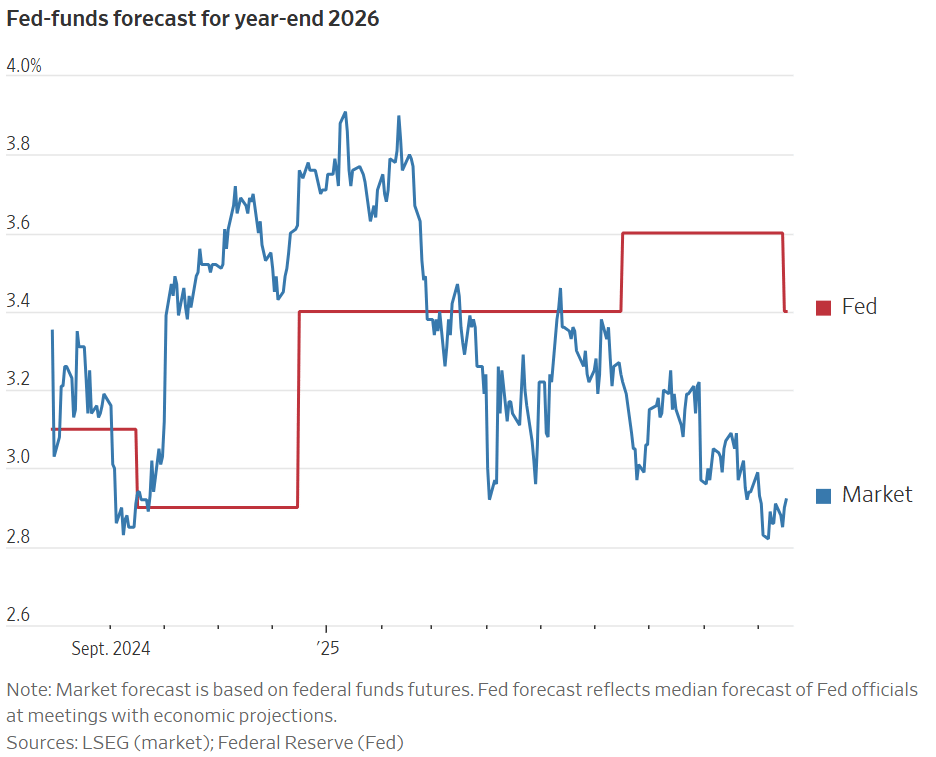

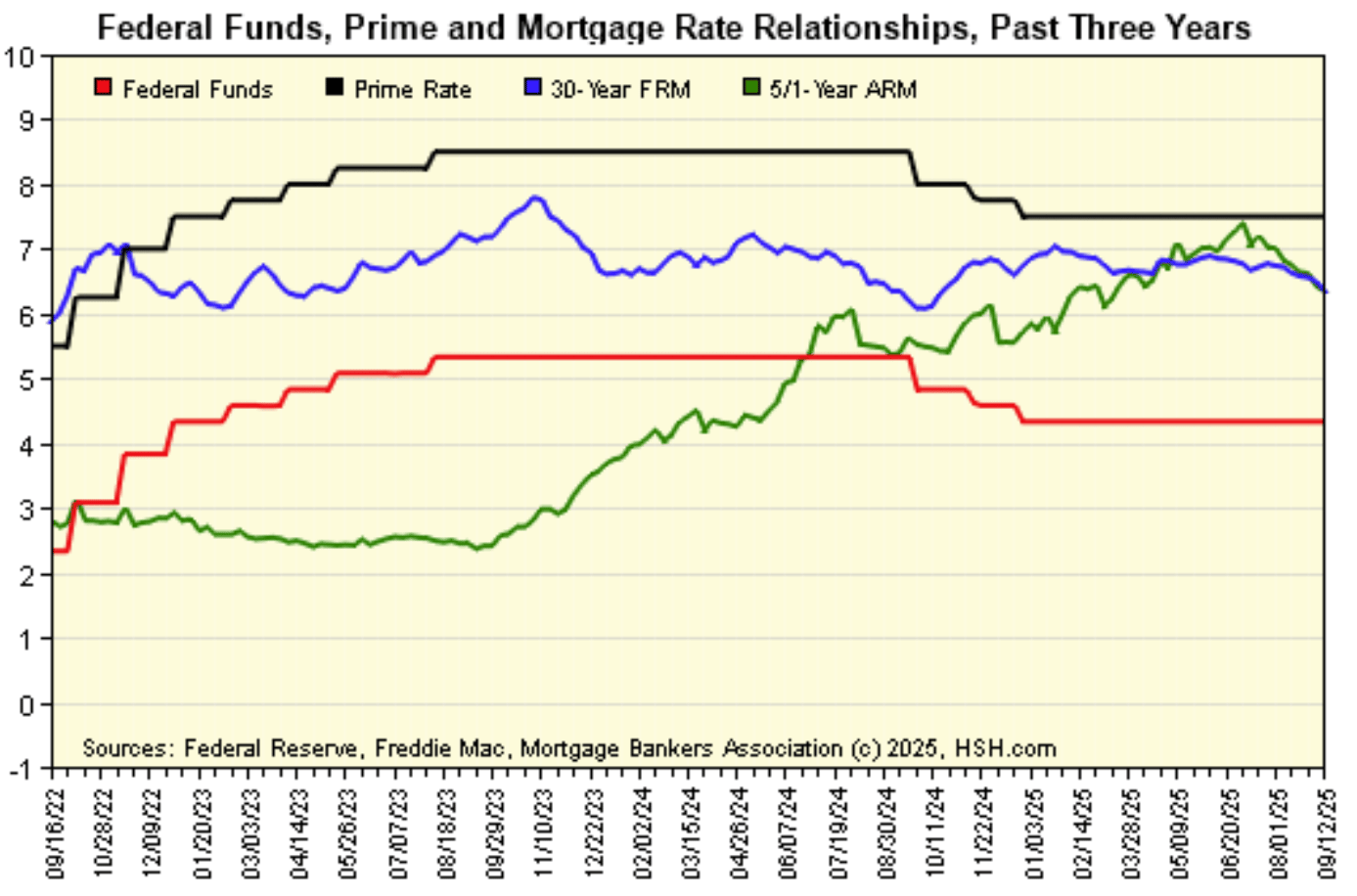

Earlier this week, the Fed cut the Federal Funds Rate by 25 basis points to a range of 4.00% to 4.25%, as a weakening labor market has become a growing concern for Jerome Powell despite ongoing inflationary pressures. During the FOMC, the Fed Chair signaled that two more cuts could follow. Markets, however, are betting on deeper easing, with forecasts for 2026 placing rates below 3%.

Markets Rally But Investors Are Still Skiddish:

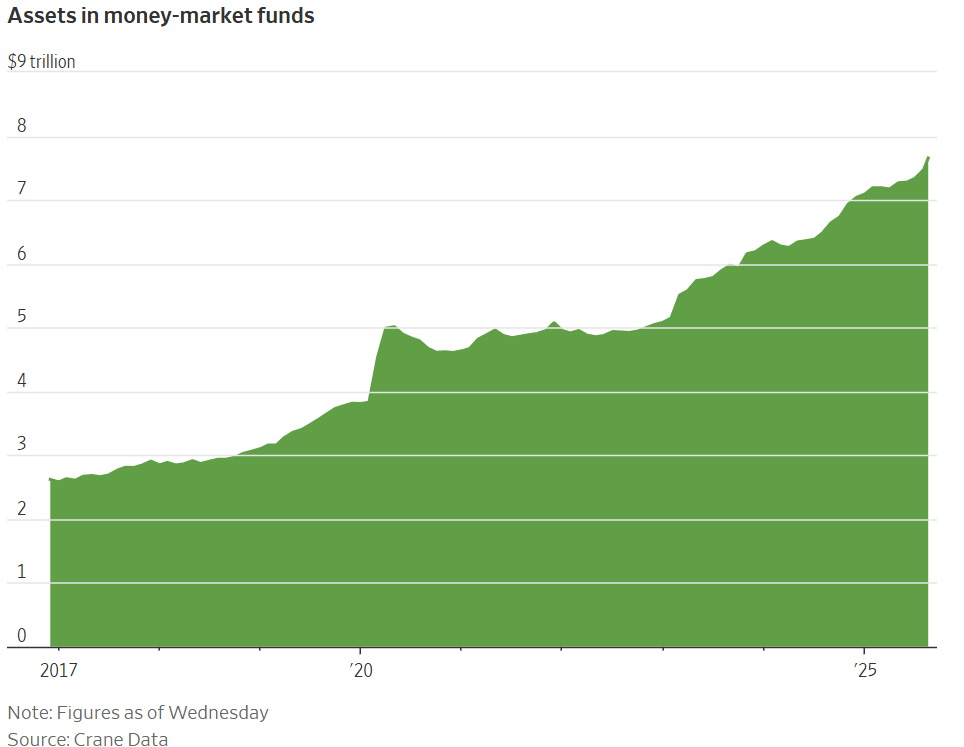

Following the Fed’s rate cut, markets surged to new all-time highs as lower borrowing costs are expected to spur economic activity. Typically, these moves drive capital into risk-on assets like stocks or crypto, but investors remain hesitant. That caution is evident in the record $7.7B now parked in money-market securities, which currently offer average yields of around 4.1% in a relatively risk-free vehicle. Coming out of the pandemic, money markets have provided the most attractive cash returns in over a decade, while equity risk premiums have hovered near zero since 2023. The result: even as markets hit fresh highs, more investors are opting to stay on the sidelines.

But Does Trying to Time The Market Really Work? Turns Out, No.

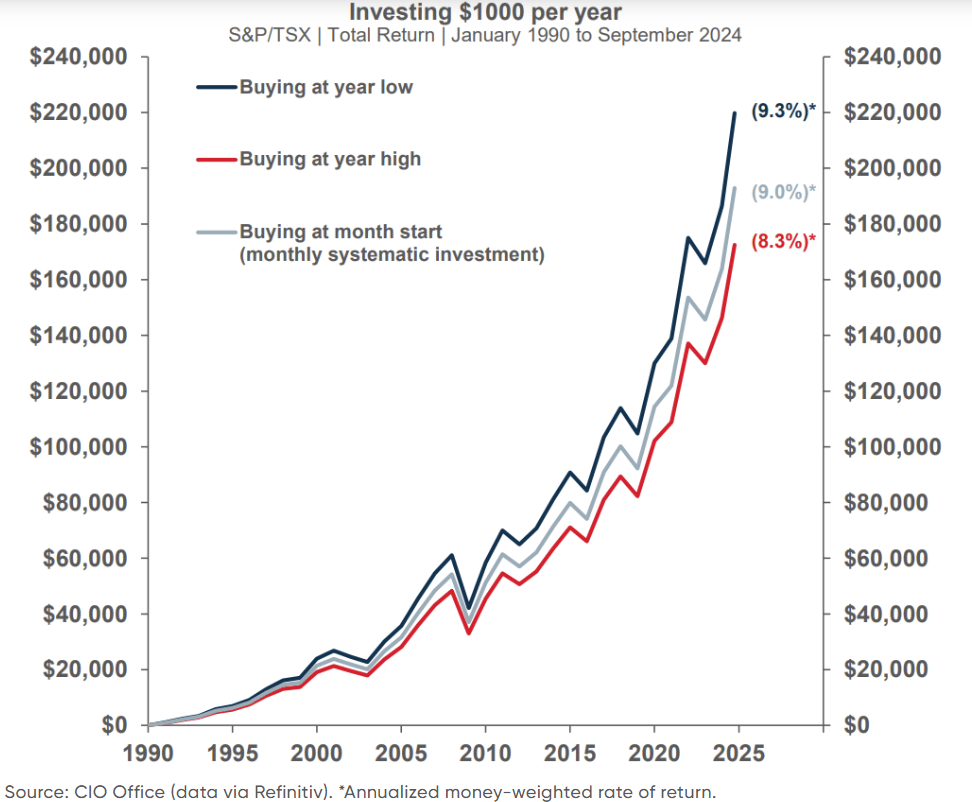

An analysis from National Bank last year compared three approaches to investing $1,000 annually over 25 years: buying at the cheapest point, the most expensive point, or systematically at the start of each month. The outcome showed that timing barely mattered. Even buying at the worst possible moment only reduced total returns by about 1%, which worked out to roughly $40,000 less over the full period. That is still far better than parking cash in money markets. Taxes add another layer to the story. Equity gains are taxed more favorably as capital gains, while money-market yields are treated as income at your marginal rate. On an after-tax basis, the case for staying invested in stocks is even stronger.

So Rates Are Down, Why Is Real Estate Not Coming Back?

It might seem natural to assume that falling rates would make mortgages more affordable and spark a rebound in real estate activity, but that is not how things are unfolding. The issue comes down to supply and demand. On the demand side, long-term mortgage rates do not track short-term rates like the Federal Funds Rate. Instead, they are tied more closely to 10-year Treasury yields, which reflect longer-term views on inflation and growth. Without a significant move lower in 30-year mortgage rates, demand remains weak. On the supply side, homeowners who locked in record-low mortgages after the pandemic are reluctant to sell and refinance at today’s higher rates. The result? An ongoing standstill in the housing market :(

“To H-1B? or Not to H-1B” - Shakespeare

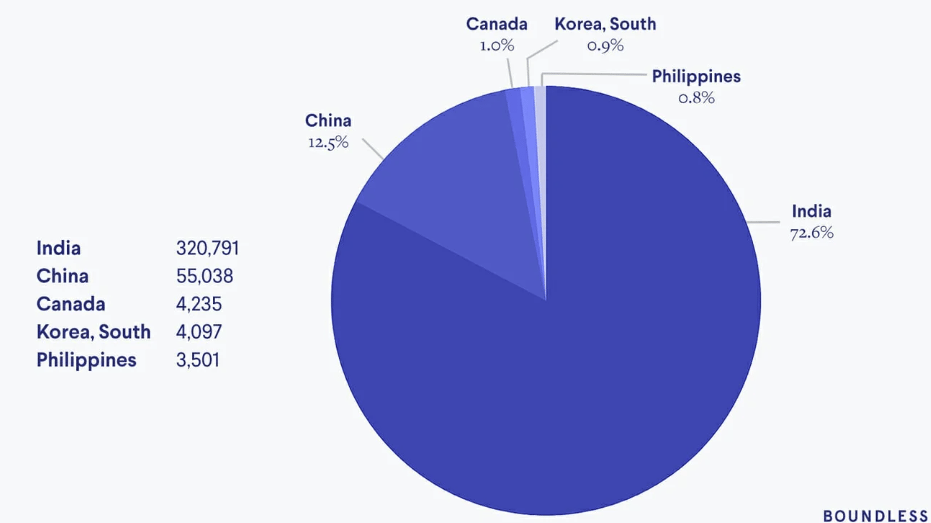

In his latest effort to prioritize American jobs, Donald Trump announced a major shift in the H-1B visa program this week, proposing a $100,000 fee for new applicants. For context, there are roughly 700,000 H-1B workers in the U.S., with about 85,000 visas issued annually. Big Tech is among the largest employers of these workers, with Amazon holding around 11,000 visas, Google 7,500, and Microsoft 6,600. Such a change could balloon labor costs and generate an additional $8.5 billion in revenue for the U.S. government. The bigger question is whether revenue is the true motive or if this is another chapter in Trump’s ongoing trade war as 73% of holders come from India and 13% from China. So is this just another bargaining chip or is the US risking an unprecedented brain drain?

Do Valuation Multiples Matter?

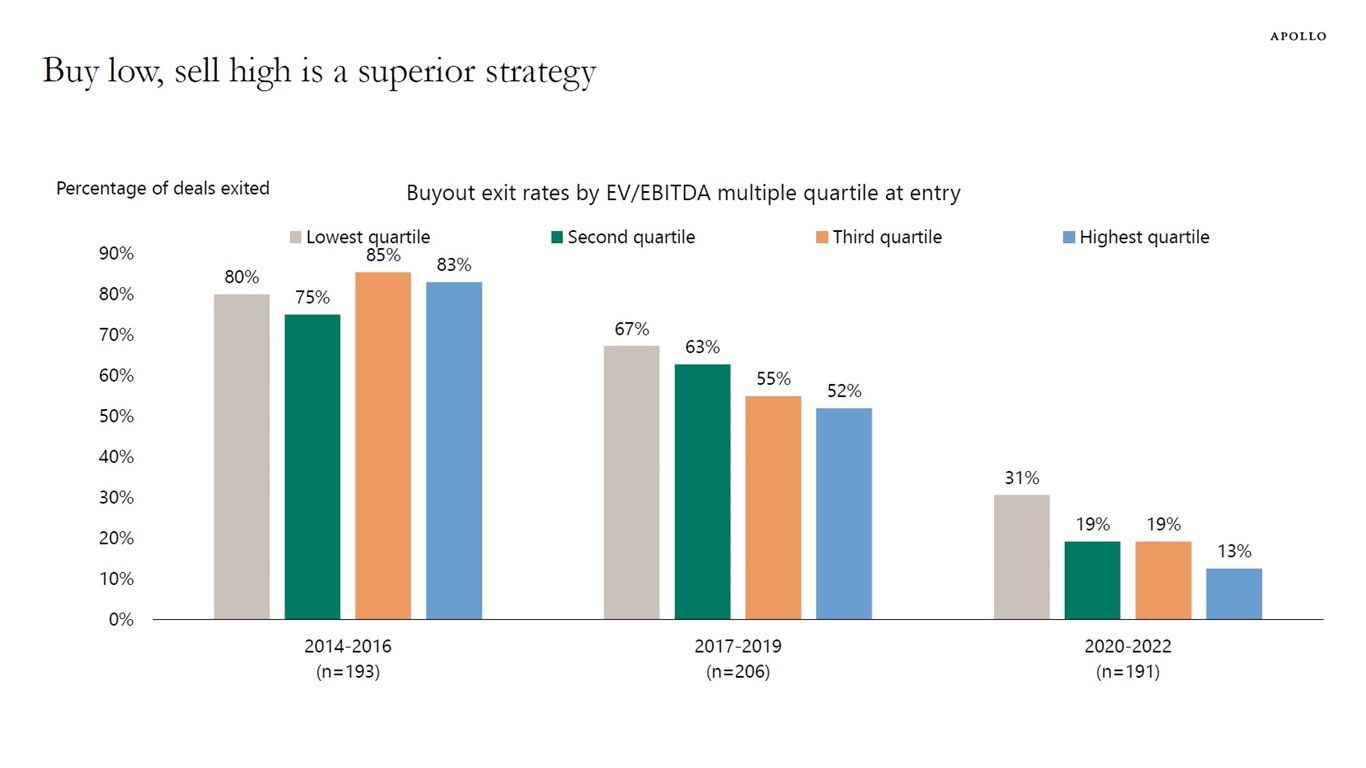

The private equity industry has experienced a sharp rise in entry valuation multiples over the past decade, fueled by a surge in dry powder. With more capital chasing a limited number of deals, it became a classic supply-and-demand imbalance, not unlike the way passive flows have reshaped valuations in public markets. The challenge now is that many of those deals are facing a liquidity crunch, as sponsors struggle to exit higher-priced assets. This pressure is most evident at the larger end of the market, which saw the steepest increase in multiples. Today, higher rates have made M&A less appealing and IPOs have been largely unavailable until very recently, leaving fewer buyers for these assets. All of this strengthens the case for allocating capital to the middle market and lower middle market, where valuations and exit opportunities remain more compelling.

A Timeless Quote:

Howard Marks: “You can’t predict, you can prepare.”

Instead of wasting energy on forecasts, investors should focus on what they can control: diversification, risk management, and maintaining flexibility to strike when opportunities arise.

If you enjoyed the newsletter, share it with a friend! It’s the best way to support us!

Happy Sunday :)