The AI Capex Conundrum

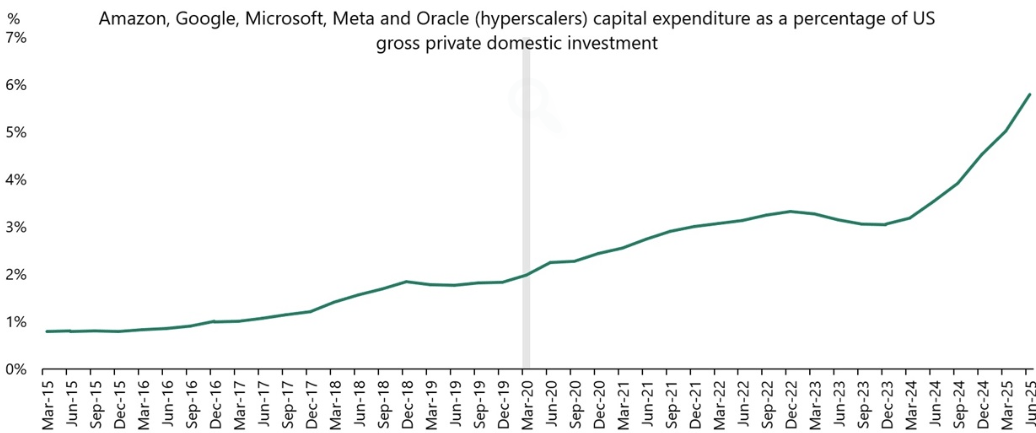

This week brought another blockbuster AI deal, with Nvidia investing $100 billion in OpenAI to build data centers and secure more of its own chips. This follows Nvidia’s $6.3 billion investment in CoreWeave and Oracle’s $300 billion contract with OpenAI announced earlier this month. Despite the circular nature of these mega-cap companies financing AI firms to boost demand for their own products, one thing is clear: AI capex is reaching unprecedented levels.

How big is the scale? Earlier this year, McKinsey estimated that AI capex could hit $7 trillion by 2030 to keep up with compute demand. That would mean data center capacity in North America jumping from 5.6 GW last year to more than 44 GW by 2030. Since 2023, hyperscaler capex as a share of gross private domestic investment has doubled, yet Bain estimates there is still a massive gap to meet projected demand.

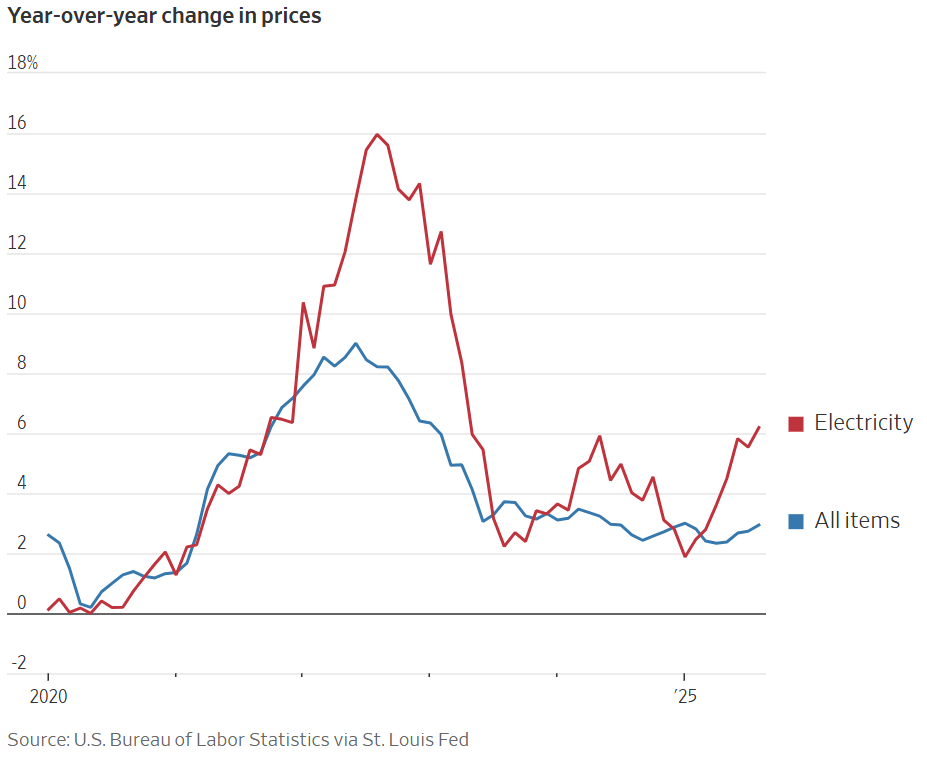

AI Arms Race Comes at a Cost… That Cost is Electricity

The knock-on effect of all this data center spend? They consume a significant amount of power and are scaling at a faster pace than North America’s power generation infrastructure. While all this spend positions the likes of OpenAI and Anthropic to dominate the global AI arms race, the cost is being borne by American families in the form of rising electricity prices, which have surged since the start of the year. So where does this leave us? It’s a matter of basic economics. We either need to massively invest in power generation to boost supply, or chip efficiency needs to improve to shift the demand curve to the left.

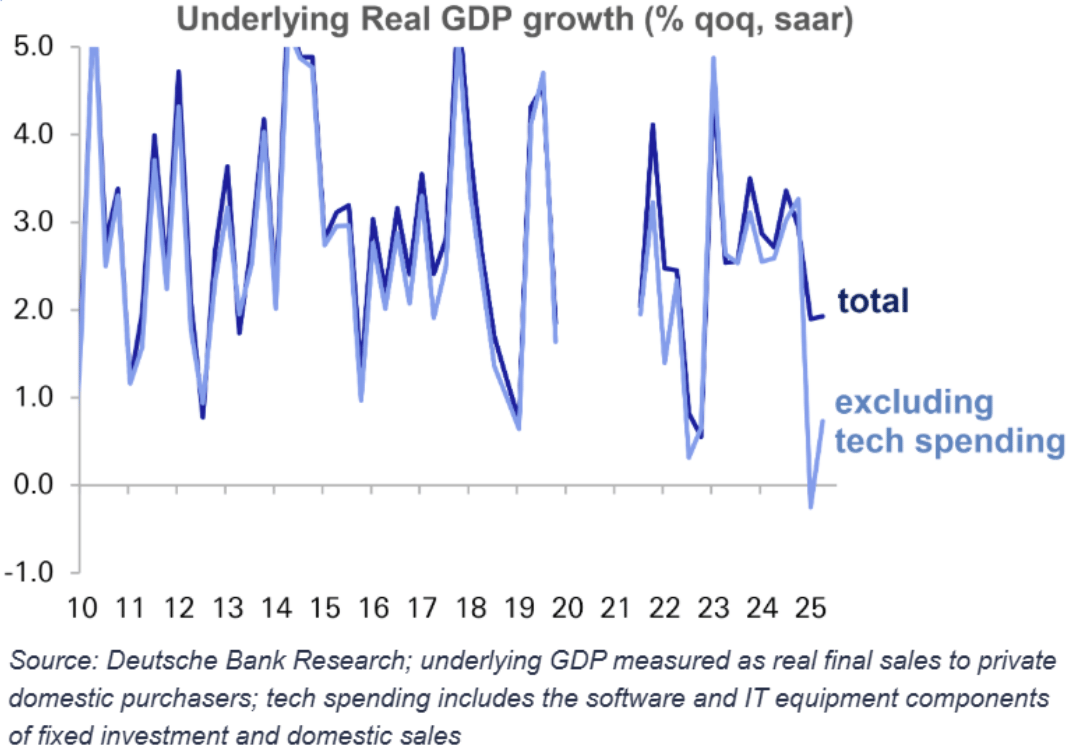

AI Spend is Propping Up The US Economy

Interestingly, the data suggests that all this AI spend is actually what is propping up US economic activity. A Deutsche Bank note to clients summarized it succinctly “AI machines—in quite a literal sense—appear to be saving the U.S. economy right now… In the absence of tech-related spending, the U.S. would be close to, or in, recession this year.” Isn’t that a good thing? Well consider this next piece.

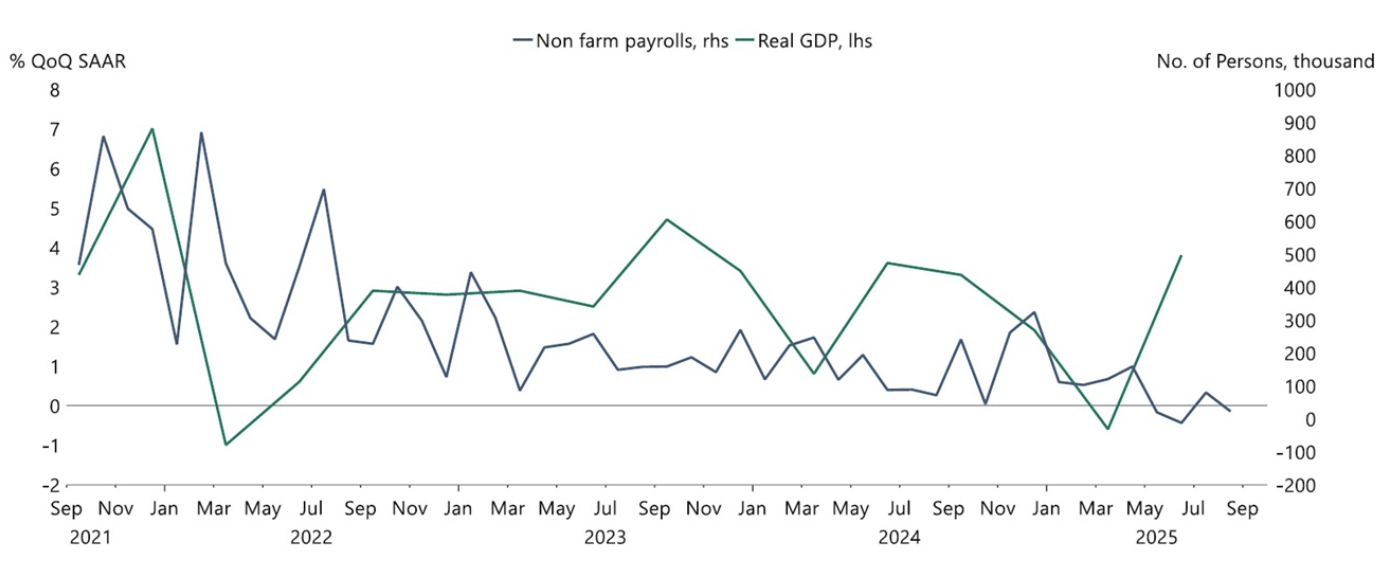

AI Investment Is Causing Difficulty For the Fed

We know the Fed’s decision to cut rates was largely driven by a weakening labor market. But now, we’re facing competing forces. Non-farm payrolls are down, signaling softness, while GDP has grown 3.8% and inflation sits at 2.9%. Normally, this kind of data would not justify a rate cut.

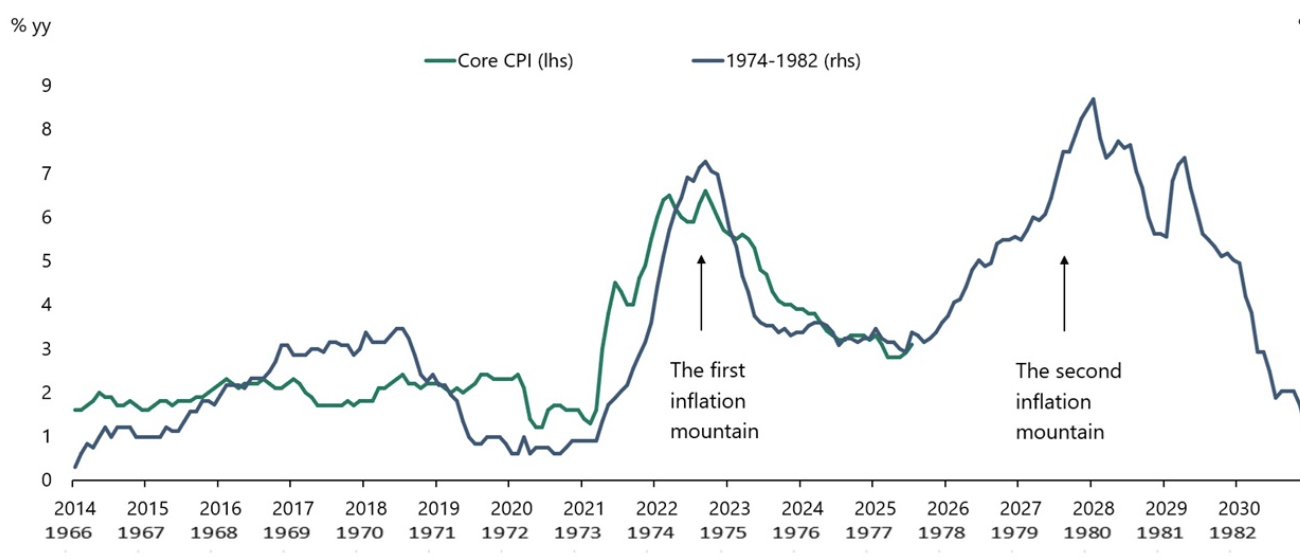

These Factors Combined Pose a Significant Inflation Concern

Apollo Chief Economist Torsten Slok recently outlined a compelling case for a potential repeat of the 1970s, with a second wave of inflation possibly hitting the U.S. economy. Economic growth remains strong, and further rate cuts could add fuel to the fire as cheaper borrowing attracts more capital (given borrowing will keep getting cheaper relative to other global markets). In a nutshell… I do not envy Jerome Powell’s job these days.

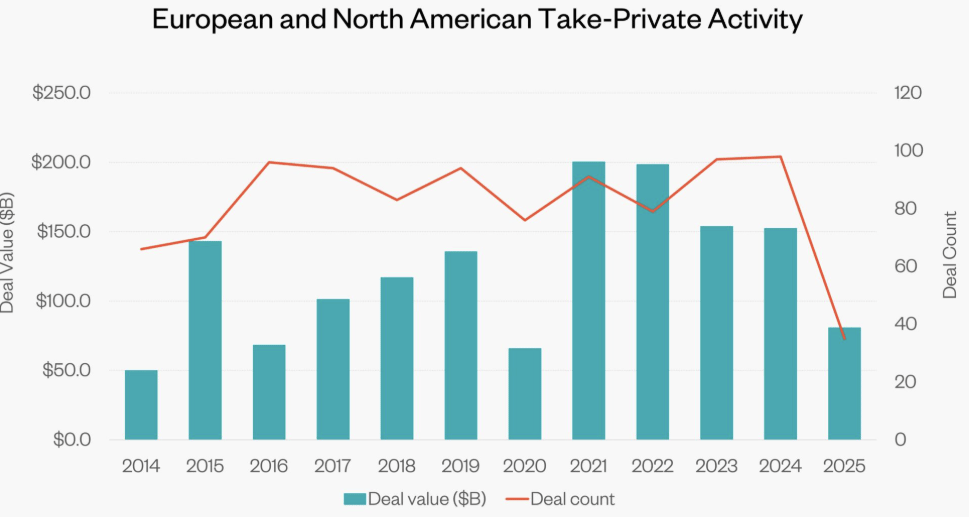

Return of the Take Private

Turning to private markets, dealmaking started off slowly as tariff uncertainty made transactions difficult, but over the summer M&A has made a comeback. This week, rumors surfaced that Silver Lake is eyeing the largest LBO ever, targeting video game designer Electronic Arts in a take-private deal that could be valued near $50 billion. That scale makes yesterday’s $2.2 billion take-private of DentalCorp by GTCR look small by comparison. Over the past five years, there has been a clear trend toward private markets, which shield companies from the constant scrutiny and volatility of public markets that often prioritize short-term performance over long-term health. The EA deal could be announced as early as next week and would set 2025 up to potentially hit an all-time high for take-private activity.

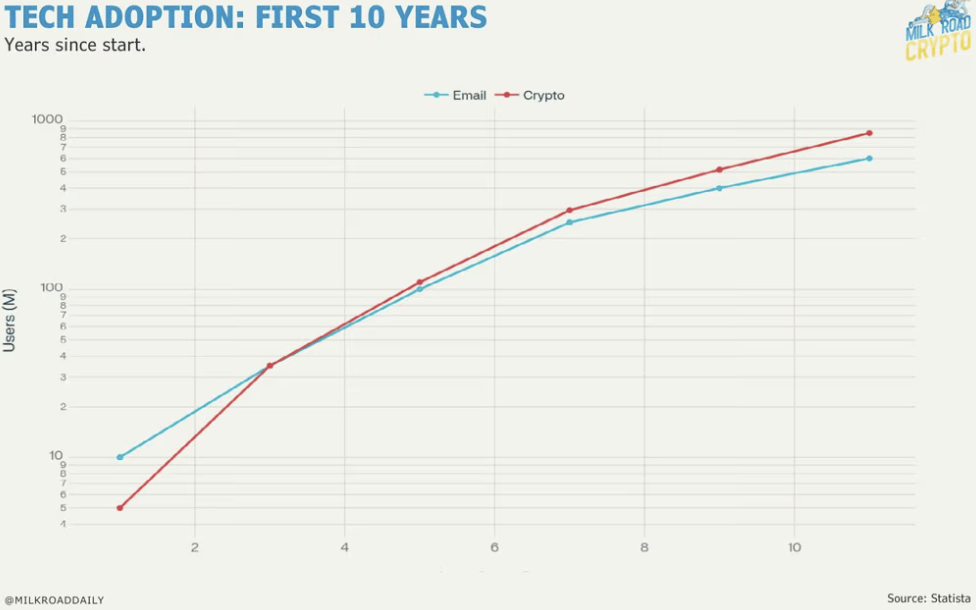

Bonus: Crypto Adoption Mirrors Email Adoption

In case you’re worried that you’re officially too late to Bitcoin or other altcoins, there’s one telling sign that we’re still early. Check out this chart comparing crypto adoption to email adoption over time. While most people like to draw parallels to the Internet, email may actually be the better proxy since, like blockchain, users can have multiple addresses.

A Timeless Quote:

Warren Buffett: “What we learn from history is that people don’t learn from history”

As these circular AI deals drive valuations to new heights and as we face a potential/repeat inflation crisis, the timeless wisdom of Mr. Buffett hits hard. Patterns emerge, yet lessons go unheeded.

If you enjoyed the newsletter, share it with a friend! It’s the best way to support us!

Happy Sunday :)